Texas Real Estate: Obama Care and the new Real Estate Tax--the REAL deal

Our legislative branch of government speaks in circles at best mos of the time. It's not a surprise that so much confusion surrounds this issue.

Re: OBAMA-CARE as it pertains to the new Real Estate Tax that will become effective in 2013. Although this is a piece of legislation from March 30, 2010, it just made it to my email box the other day from a client. I bet you've received it too. My clients wrote to me to ask, "Mari, is this true??"

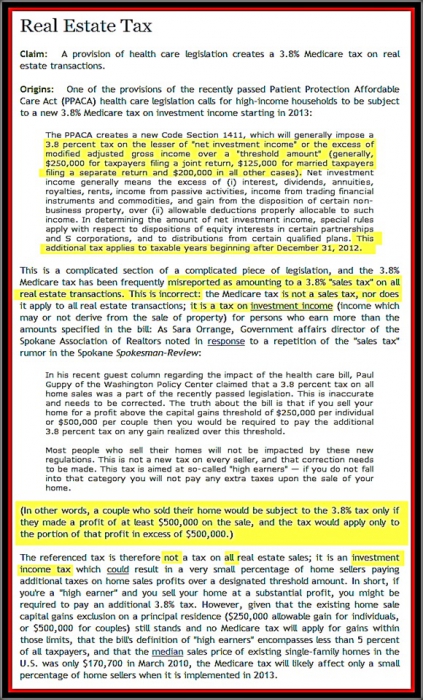

Basically, the email that is circulating says that starting in 2013 a 3.8% tax will be levied on ALL Real Estate transactions. What is the truth? For the answer, I went directly to the "Public Law 111-152 H R. 4872" dated March 30, 2010.

Please, take a look for yourselves....

PUBLIC LAW 111-152 [H.R. 4872] MAR. 30, 2010

HEALTH CARE AND EDUCATION RECONCILIATION ACT OF 2010 Sec. 1402.

UNEARNED INCOME MEDICARE CONTRIBUTION.

(a) Investment Income.-- (1) In general.-- Subtitle A of the Internal Revenue Code of 1986 is amended by inserting after chapter 2 the following new chapter:

CHAPTER 2A--UNEARNED INCOME MEDICARE CONTRIBUTION "Sec. 1411. Imposition of tax. "Sec. 1411. IMPOSITION OF TAX.

"(a) In General.--Except as provided in subsection (e)-- "(1) Application to individuals.-- In the case of an individual, there is hereby imposed (in addition to any other tax imposed by this subtitle) for each taxable year a tax equal to 3.8 percent of the lesser of-- "(A) net investment income for such taxable year, or "(B) the excess (if any) of-- "(i) the modified adjusted gross income for such taxable year, over "(ii) the threshold amount. "(2) Application to estates and trusts.-- In the case of an estate or trust, there is hereby imposed (in addition to any other tax imposed by this subtitle) for each taxable year a tax of 3.8 percent of the lesser of- -

"(A) the undistributed net investment income for such taxable year, or "(B) the excess (if any) of-- "(i) the adjusted gross income (as defined in section 67(e)) for such taxable year, over "(ii) the dollar amount at which the highest tax bracket in section 1(e) begins for such taxable year. "(b) Threshold Amount.--For purposes of this chapter, the term 'threshold amount' means-- "(1) in the case of a taxpayer making a joint return under section 6013 or a surviving spouse (as defined in section 2(a)), $ 250,000, "(2) in the case of a married taxpayer (as defined in section 7703) filing a separate return, 1/2 of the dollar amount determined under paragraph (1), and "(3) in any other case, $ 200,000. "(c) Net Investment Income.--For purposes of this chapter--

"(1) In general.-- The term 'net investment income' means the excess (if any) of-- "(A) the sum of-- "(i) gross income from interest, dividends, annuities, royalties, and rents, other than such income which is derived in the ordinary course of a trade or business not described in paragraph (2), "(ii) other gross income derived from a trade or business described in paragraph (2), and "(iii) net gain (to the extent taken into account in computing taxable income) attributable to the disposition of property other than property held in a trade or business not described in paragraph (2), over "(B) the deductions allowed by this subtitle which are properly allocable to such gross income or net gain. "(2) Trades and businesses to which tax applies.-- A trade or business is described in this paragraph if such trade or business is--

"(A) a passive activity (within the meaning of section 469) with respect to the taxpayer, or "(B) a trade or business of trading in financial instruments or commodities (as defined in section 475(e)(2)). "(3) Income on investment of working capital subject to tax.-- A rule similar to the rule of section 469(e)(1)(B) shall apply for purposes of this subsection. "(4) Exception for certain active interests in partnerships and s corporations.--

In the case of a disposition of an interest in a partnership or S corporation-- "(A) gain from such disposition shall be taken into account under clause (iii) of paragraph (1)(A) only to the extent of the net gain which would be so taken into account by the transferor if all property of the partnership or S corporation were sold for fair market value immediately before the disposition of such interest, and "(B) a rule similar to the rule of subparagraph (A) shall apply to a loss from such disposition. "(5) Exception for distributions from qualified plans.-- The term 'net investment income' shall not include any distribution from a plan or arrangement described in section 401(a), 403(a), 403(b), 408, 408A, or 457(b).

"(6) Special rule.-- Net investment income shall not include any item taken into account in determining self-employment income for such taxable year on which a tax is imposed by section 1401(b). "(d) Modified Adjusted Gross Income.--For purposes of this chapter, the term 'modified adjusted gross income' means adjusted gross income increased by the excess of-- "(1) the amount excluded from gross income under section 911(a)(1), over "(2) the amount of any deductions (taken into account in computing adjusted gross income) or exclusions disallowed under section 911(d)(6) with respect to the amounts described in paragraph (1).

"(e) Nonapplication of Section.--This section shall not apply to-- "(1) a nonresident alien, or "(2) a trust all of the unexpired interests in which are devoted to one or more of the purposes described in section 170(c)(2)(B).". (2) Estimated taxes.-- Section 6654 of the Internal Revenue Code of 1986 is amended-- (A) in subsection (a), by striking "and the tax under chapter 2" and inserting "the tax under chapter 2, and the tax under chapter 2A"; and (B) in subsection (f)-- (i) by striking "minus" at the end of paragraph (2) and inserting "plus"; and (ii) by redesignating paragraph (3) as paragraph (4) and inserting after paragraph (2) the following new paragraph: "(3) the taxes imposed by chapter 2A, minus". (3) Clerical amendment.-- The table of chapters for subtitle A of chapter 1 of the Internal Revenue Code of 1986 is amended by inserting after the item relating to chapter 2 the following new item:

CHAPTER 2A--Unearned Income Medicare Contribution". (4) Effective dates.-- The amendments made by this subsection shall apply to taxable years beginning after December 31, 2012.

Now, here is an explanation in more understandable everyday language:

This information is from Snopes

So, what are we to do when our Inbox is crammed FULL of opinion, commentary, misinterpretation and misinformation.

You can do what my clients did, they called their REALTOR. We are here to serve.

Or, as we are in the information age, we do have the opportunity to seek out clarity And part of serving you means answering your questions without bias.

Although "Clarity" may always be diametrically opposed to anything even remotely associated with our legislative branch of government, this information is public.

This "Public Law" will change things for some of the top earners in this country. Be sure whatever your opinion is, to allow your voice to be heard, after collecting the facts. Then, by voting and maybe even becoming active in a political action committee of some sort.

Speaking of Political Action Committees---if you are interested in finding out more about the concerns and efforts of Texas Realtors on behalf of the rights of property owners----then you will be interested in Texas Real Estate's voice in its own Political Action Committee called TREPAC (Texas Real Estate Political Action Committee).

You can access more about TREPAC by clicking here

TREPAC is concerned with protecting the rights of property owners. Home ownership is one of the incredible privileges we have as citizens. One to be cherished and protected.

What are my feelings about home? I LOVE home.

To me:

- HOME is heart,

- HOME is Peace,

- HOME is a Place where your Heart can Sing in any key you choose.

- HOME is not just a house...it's a place where families build memories

- a place where friends gather and laugh

- a place where we can comfort each other in times of darkness.

- HOME is an incredibly important fiber in the fabric that IS AMERICA.

The way I feel about HOME is one of the primary reasons I AM A TEXAS REALTOR. I LOVE home. I LOVE helping others to find the physical structure that becomes a major part of the fabric of THEIR lives.

HOME is much more than wood, concrete, shingles, sheet rock, etc.

I LOVE my JOB!

I AM A TX REALTOR!

Mari Montgomery

Affiliate Broker, CRS, GRI

2012 Houston Five Star Real Estate Agent, 2010 Winner of the QSC Best in the Business Award, 2009 Winner of the People's Choice Award---Best Realtor in Walker County, #1 Realtor Keller Williams Conroe/Lake Conroe/Huntsville. Member, Platinum Circle Keller Williams Realty International.

Search for properties HERE!

Affiliate Broker, Realtor®, CRS®, GRI®

2012 Houston Five Star Real Estate Agent, 2010 Winner of the QSC Best in the Business Award, 2009 Winner of the People's Choice Award-Best Realtor in Walker County, #1 Realtor Keller Williams Conroe/Lake Conroe/Huntsville. Member, Platinum Circle Keller Williams Realty International, #1 Single Family Home Sales in Walker County

284 Interstate 45 S, Ste 1, Huntsville TX 77340 Serving: Huntsville TX including Elkins Lake/ Lake Conroe/ Lake Livingston

Copyright 2009-2012.© Mari Montgomery Realty, East Texas Property Search, Inc. Mari Montgomery. All Rights Reserved.

Tagged: MariMontgomeryRealty.com NEWS and Local Events--Log: Huntsville TX, Lake Conroe, Lake Livingston, Real Estate, Homes

Login or create a profile to post a comment